Casino Money Laundering

Posted : admin On 4/4/2022- Using Casinos To Launder Money

- Trump Fined 10 Million

- Sands Casino Money Laundering

- Las Vegas Casino Money Laundering

- Casino Money Laundering Cases

There are several key methods that criminals deploy when money laundering. Many groups rely on breaking up the deposits into small tranches to avoid flagging in a practice known as structuring. Others simply buy chips with cash, spend some time on the casino floor and attempt to cash them out as winnings. There are many methods that involve the use of shell companies to conceal transactions, bank accounts and individuals involved. It is an incredibly complex area of finance and one that the authorities are fighting tirelessly to stamp out in all forms.

Download Prevention of money laundering and combating the financing of terrorism guidance for remote and non-remote casinos in full. Principles to be followed. All casinos (both premises based and remote) must have appropriate systems and processes to prevent money laundering and terrorist financing. To achieve this, as an operator, you should. Basic Principles and Policies to Combat Money Laundering/Terrorist Financing. – Casinos shall be regulated to prevent money laundering and terrorist financing, as well as from undermining the Philippine financial system. Casinos shall therefore apply the following principles throughout their businesses. Crown's former executive chairman John Alexander says he was unaware of red flags in the company's casino operations pointing towards suspected large-scale money laundering, despite Crown. Money laundering can happen in terms of the cash exchanged for the chips in casinos. It could also happen in terms of the wire transfers and credit card swiping. The most easily identifiable feature of the money laundering in the casino is when money is transferred from several different financial institutions or agencies. Their collaboration sparks concerns regarding casino money laundering ties between the two Canadian provinces. Illegal gambling operation is harmful to the federal and the provincial governments it directly affects, as the gambling revenue amassed fails to be reinvested in the casino host community.

What Makes Casinos the Perfect Target?

Casino gambling is a brilliant way to make money disappear, and reappear in separate bank accounts. Obviously, the casino industry takes measures to make this difficult which we will explain in more detail down the page. The casino does not necessarily need to be complicit in the money laundering activities for criminals to be successful, but many have known to be in the past. With so many underground markets operating throughout Asia, Europe and America – criminals have plenty of casinos and sports betting operators they can exploit to launder their dirty cash.

Without the compliance of the regulated casino industry, this is an uphill battle that the authorities cannot fight alone. There are many motivated, and well-funded criminal gangs that are persistent in their efforts to use casinos to launder money. Within the casinos, themselves exist many vulnerabilities that can be easily exploited. The staff in casinos represent one of the biggest risk factors for money laundering, as they are often low-paid administrative staff that can be easily bribed or threatened to assist the criminals laundering their money.

But what makes the casino money laundering so appealing rather than off-shore shell companies or other such methods.

The three biggest reasons for money laundering at casinos are:

- Casinos and sports betting operators have enormous cash flows that make it easy to bets intended for money laundering within the sea of transactions flowing in and out.

- It doesn’t matter who you are, whether you’ve been convicted of financial crimes or where your money comes from. The majority of casinos around the world are happy to accept wagers from anyone with hard cash to gamble.

- High-rollers are a major source of profit for many casinos – in order to maintain a strong a favorable relationship with the client, staff may ignore or turn a blind eye to any suspicious transaction.

As you can imagine from the above statements, revenue and profit are huge motivating factors for the casinos. It is difficult to deny that casinos are powerless to stop this activity, and certainly more needs to be done from industry regulators to enforce systematic checks on customers that set-off red flags with suspicious depositing activity.

Industry regulators certainly have a part to play, by scrutinizing large casino companies around the world they regularly audit and analyze financial statements looking for irregularities. The biggest operators make enough money from legal transactions, and it tends to be smaller casinos in less stringent jurisdictions that are complicit with money launderers. In Asia, there has been a long-term problem with this illegal activity – and a thriving underground gambling industry.

Things are a little different online, especially if you are gambling in the UK or another strictly regulated market. If you are worried about what might be going on at your favorite casino site, have a look at our guide to casino safety to see what reputable sites are doing to keep everything above board.

Fighting Against Money Laundering with Regulation

Within tightly regulated industries such as Europe and North America casino money laundering is a very low threat to operations. The regulators in these territories are very diligent, using a mixture of law enforcement integrations, technology, and correct procedures to mitigate the problems. Communities in Europe and North America are more resistant to the risks associated with exposing themselves to organized crime and are more active in their resistance to money launderers.

Using Casinos To Launder Money

However, the Asian gambling industry is worth over $180bn annually. Before the market became such an enormous part of the local economy, a strong and thriving underground gambling scene was firmly established. Even now that big corporate casino interests have a firm hold on the market, the dark underbelly still remains.

Certain casinos within Asia are notorious for being connected to the criminal underworld – on a much larger scale than any European equivalent. It has been proven in the past that the Yakuza has a strong grip over many gambling operators in Japan, and in South-East Asia there have been several high-profile match-fixing and money laundering busts in the past decade.

The tide is turning though. Many of these casinos have begun enforcing identity checks on their new customers. More importantly, the range of payment options that was previously available has been refined to a select few, in this scenario payments are much more easily traced. The ability to use different accounts for deposits and withdrawals has enabled casino money laundering in the past, ending this practice will do a great deal for squashing the remnants of money laundering in this industry.

Is the Game Up for Money Launderers?

Obstructing the use of casinos as a vehicle for money laundering is a constant battle between law enforcement, criminals and casino operators. In the UK, customer check procedures are continuously improving, and in its current state, the system is highly impenetrable. The same rings true for much of Europe and North America. However, the lackluster approach to financial scrutiny in certain jurisdictions continues to allow the practice of money laundering to sneak under the radar. The amount of money involved is truly staggering, with that comes powerful and illicitly motivated groups who are determined for their business to go uninterrupted. The battle rages on between criminals and the authorities who are often left chasing shadows.

You can find out more info about how casinos stay safe from crime and how internet gambling is regulated in this section of our guide to real money casino gambling.

Casinos have historically been at risk of exploitation by those seeking to launder criminal property. We look at five things you need to know about the problem, rules and changes to sector guidance.

1. Why is this important?

The nature of services and products offered by the gambling industry can make it attractive to criminals seeking to launder or disguise the origins of criminally derived funds. Significant risk factors in this industry include the prevalence of cash transactions, accessibility to multiple premises and anonymity on the part of the customer.

Trump Fined 10 Million

2. Who is covered by the rules?

New anti-money laundering provisions relating to casinos were brought in by the Money Laundering Regulations 2017 (MLR 2017) on 26 June 2017. A key change is that all casino operators, both remote and non-remote, are now caught by MLR 2017, rather than simply holders of a casino operating licence. A remote casino operator will be caught by the MLR 2017 if they have at least one piece of remote gambling equipment situated in the UK or if the gambling facilities provided by the remote casino are used in the UK.

This means that non-casino gambling providers, such as betting shops, are not covered by the MLR 2017.

3. What are the rules?

Under the MLR 2017, casino operators have a legal obligation to do the following:

- Risk assessment: conduct a written risk assessment in respect of money laundering risks faced by the business and ensure that there are adequate procedures in place to deal with those risks.

- Customer due diligence: conduct risk based customer due diligence (CDD) when they:< >establish a business relationshipsuspect money laundering or terrorist financingdoubt the veracity or adequacy of documents or information previously obtained for the purposes of identification or verification.Nominated officer: appoint a member of the firm as their nominated officer (i.e. outsourcing is no longer possible) as well as a member of the board of directors (or equivalent) as the officer responsible for compliance.

- Reliance on third parties: accept ultimate responsibility for compliance with MLR 2017, even where they are entitled to rely on CDD carried out by third parties.

In July 2010, the Gambling Commission, which oversees the casino industry’s compliance with their anti-money laundering obligations, published a guidance note entitled “Money laundering: the prevention of money laundering and combating the financing of terrorism: Guidance for remote and non-remote casinos” (PDF). This guidance was updated in 2011 and 2016 following changes in the law.

4. How are the rules/guidance changing?

Sands Casino Money Laundering

In light of the changes brought about by the MLR 2017, and also the Criminal Finances Act 2017, the Gambling Commission’s guidance note has been revised to a new fourth edition to assist casino operators in complying with the latest requirements. The updated guidance went out to consultation in July 2017. Responses are sought by 8 September 2017.

The consultation document invites feedback on the above amendments and, in addition, asks for views on whether or not the Gambling Commission should remain the sole supervisory authority for money service business activities provided by non-remote casinos.

Las Vegas Casino Money Laundering

5. What can casino operators do to comply with the amended regulations?

Casino operators can ensure they have effective anti-money-laundering and counter-terrorist financing measures in place by taking the following steps:

Casino Money Laundering Cases

- Risk assessment: review and revise the risk assessment, covering issues such as customer profile, premises and remote sites and incidents of actual or suspected attempted money laundering.

- Policies and procedures: review and revise policies and procedures in light of the identified risks. Ensure that the policies and procedures are properly disseminated and appropriate training is provided on them to front line staff.

- Senior management commitment: senior management must be fully engaged in developing and maintaining procedures and controls which are necessary to manage the risks identified in the casino operator’s risk assessment.

- Record keeping: keep records of all anti-money-laundering policies, procedures and controls and all ongoing transactions with customers. Records of CDD identification and verification must be maintained for at least 5 years.

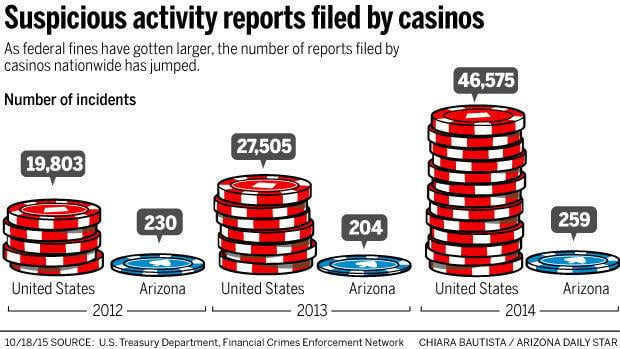

- Suspicious activity reports: providing appropriate training to all relevant employees to enable them to make a report where they know, suspect (or have reasonable grounds to know or suspect) that a person is engaged in actual or attempted money laundering or terrorist financing.